By Bruce Q. Thompson, B.Admin, CFP®

From the moment our children are born we want the best for their future. Success is never guaranteed, but we hope to be able to offer them opportunities. And what better opportunity is there than education? So it seems like a straight forward assumption that we would contribute to a Registered Education Savings Plan (RESP).

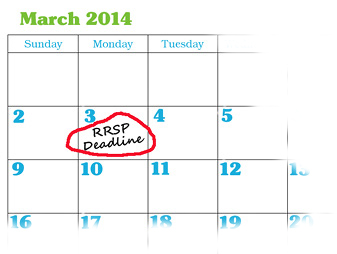

But what about our own future? What about contributing to a Registered Retirement Savings Plan (RRSP)? Canadians are living longer, and the cost of living is always on the rise. If we don’t have a solid retirement plan, are we at risk of living in our well educated child’s basement? OK, that may be a tongue-in-cheek option, but the question of where to place our investment dollars is valid. What’s a parent to do?