By Alison Stafford, FPSC Level 1TM Certificant in Financial Planning

At this time of year lots of people set goals, and it’s certainly not unusual for one of those goals to be about money. This year I’m going to pay down my credit debt, or this year I am going to spend less on dining out and save for a trip, or, I’m going to put more into my retirement savings. All worthy goals. But there is another money goal that is often neglected, one that would reduce the need for goals that “fix” our past behavior with promises to make better choices this year. That better money goal is: This year I’m going to focus on my financial knowledge.

At this time of year lots of people set goals, and it’s certainly not unusual for one of those goals to be about money. This year I’m going to pay down my credit debt, or this year I am going to spend less on dining out and save for a trip, or, I’m going to put more into my retirement savings. All worthy goals. But there is another money goal that is often neglected, one that would reduce the need for goals that “fix” our past behavior with promises to make better choices this year. That better money goal is: This year I’m going to focus on my financial knowledge.

The more we understand the mechanics of money, the more engaged we are with our finances, the more likely we are to make good choices every day, not just for the first few weeks of the New Year. So what holds people back?

Sometimes they worry that they aren’t as financially “savvy” as they believe they should be. They are embarrassed to admit what they don’t know, so they don’t want to ask questions. This can be especially true for people who are very successful in their careers and earn a lot of money. But the ability to earn money does not directly equate with feeling confident managing money. That takes a separate education from the one that made them professionally successful.

Sometimes they worry that they aren’t as financially “savvy” as they believe they should be. They are embarrassed to admit what they don’t know, so they don’t want to ask questions. This can be especially true for people who are very successful in their careers and earn a lot of money. But the ability to earn money does not directly equate with feeling confident managing money. That takes a separate education from the one that made them professionally successful.

It’s important to become comfortable talking about money. Sure we talk with friends, co-workers and neighbours about the high cost of groceries or the roller coaster ride of gas prices, but that’s the financial equivalent of talking about the weather.

There are lots of ways to jump-start our financial knowledge and begin meaningful and helpful conversations:

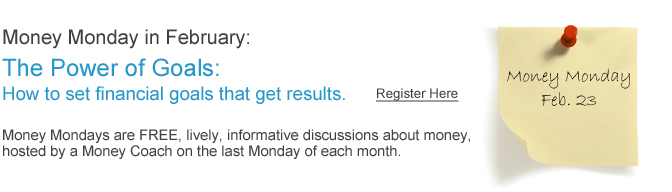

- Every month Money Coaches Canada hosts Money Mondays. The last Monday of each month our coaches facilitate a free, themed discussion on some aspect of money and finance. (February’s topic: The power of goals: How to set financial goals that get results Learn more).

- Set a financial education goal for yourself, pick an aspect of money management you would like to understand better and consciously go about learning more. Or, to keep it simple, become a regular reader of financial magazines like MoneySense.

Give yourself an investment check-up. Ask yourself these questions. If you don’t know, or don’t like the answers, book an appointment with your investment advisor.

Give yourself an investment check-up. Ask yourself these questions. If you don’t know, or don’t like the answers, book an appointment with your investment advisor.- Start a financial book club. Learning with others is more fun and less daunting. Get a group of friends together and read and discuss one of the many finance books available.

Almost any advice you read on goal setting will suggest that sharing your goals increases the likelihood of achieving them, so I would like to encourage you to share your financial goal by leaving a reply in the comments below or on our Money Coaches Canada Facebook page

As further incentive, anyone who shares their financial goal before February 13th, 2015, will be entered in a draw to win one of five copies of “Unstuck: How to get out of your money rut and start living the life you want” written by Money Coaches Canada and Women’s Financial Learning Centre co-founders Karin Mizgala and Sheila Walkington, which has just been released as an ebook. (The 5 winners of the draw will have their choice between the book or ebook format). “Unstuck” would also be an excellent choice as a financial book club selection. Learn more here.

My goal is to finish paying off my sweetie’s student loan in the next year so that we can use that extra money that would be freed up in our budget to get my eyes fixed!

Great goal! All the best to you Sarah!!